Dear client,

It is my great pleasure to address you as EDM CEO, a position I assumed on 30 June 2022. My intention is to publish this letter twice a year, in April and October, alternating with that of our Chairwoman, María Díaz-Morera, published in January and July. I hope you find it useful and will not hesitate to send me your comments and suggestions via email (cllamas@edm.es).

We are entering the last quarter of a tumultuous year, characterised by tremendous uncertainty over the future of the economy and of economic and monetary policy, to say nothing of the considerable geopolitical tension we are experiencing.

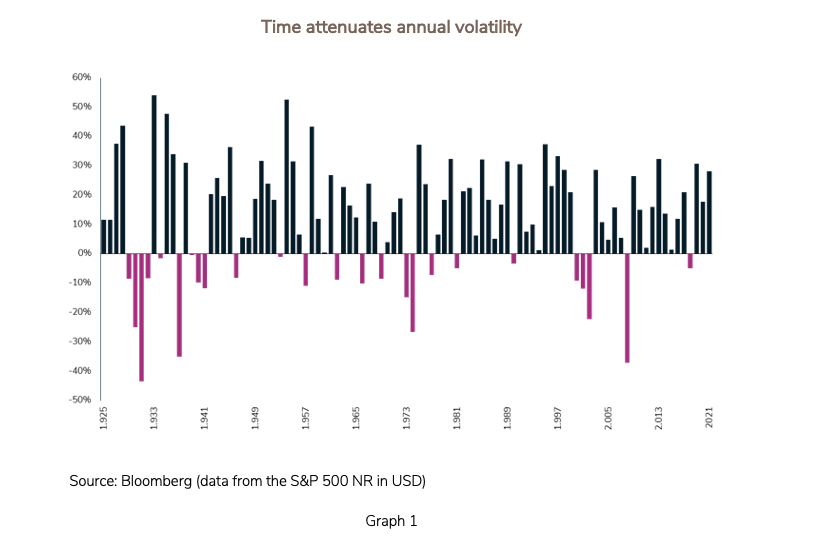

The financial market fallout of this uncertainty is high volatility, which may come as a surprise to novice investors, but which is commonplace in the history of markets. As Graph 1 illustrates, the years of negative stock market results represent only a small percentage of the overall total, while the majority of years yield positive results: history proves the world doesn’t end. This reminder is not intended to minimise present concerns, simply to put them into perspective.

1. Conflicting views

Results in 2022 have been unfavourable, both among bonds and equities, reflecting the pessimism of many investors over the economic future. This evolution and the volatility that comes with it are evidence of conflicting views on short-term economic and market trends. I would like to discuss EDM’s approach to this situation, with respect to three aspects:

A. Macro vs. micro

B. Preference for value over growth

C. Different interpretations of the impact of inflation

A. Macro vs. Micro

Unpredictability about the future in general and about economic forecasts in particular permeates our investment style. Consequently, rather than focus on macroeconomic analyses, our company bases its investment decisions on the individual merits of stocks and bonds, meaning, their quality and valuation. From this perspective, we abstain from making decisions based on the fluctuating views and sentiments of investors that alternate between fear of a recession and fear of inflation, or of both.

Naturally, we re-examine our convictions regarding the quality of the assets that comprise the investment portfolios at times (like the present) of enormous pessimism and selling pressure. As a result, we try to convey to our clients the trust that our demanding selection merits, based on our proximity to the companies.

In this third quarter, the prevailing pessimism has triggered a sudden shift in trend since mid-August, further compressing multiples (P/E ratios). In our opinion, this evolution is divorced from the quality of the businesses in which we invest, businesses that we believe will successfully weather the period of slower growth that lies ahead.

Of the two drivers that essentially determine the results of investments in listed shares, earnings per share (EPS) and multiples (P/E ratios), the former is the most stable, while the latter is primarily responsible for market fluctuations.

This “micro” approach may seem excessively modest, but it allows us to be confident—with the data in hand—in a positive and predictable final result.

B. Preference for value over growth

Because volatility also manifests itself in stock markets through frenetic, repeated sector rotation, many strategists recommend alternately investing in either “value” or “growth” shares and, after a few months, investing in the opposite.

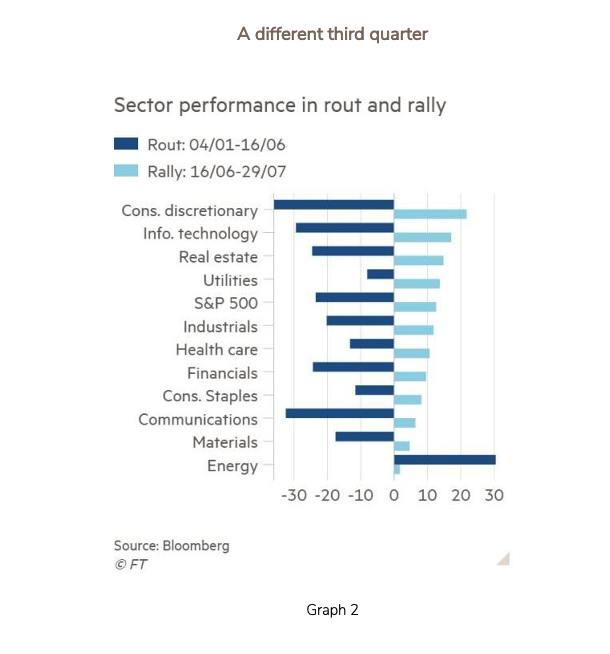

These pirouettes are motivated by a macroeconomic view that shifts between recession and inflation according to the comments of the central banks and the tone of their monetary policies. In the Opinion Flash of late August, we alluded to this fact and included the graph below, which illustrates how markets favoured the different sectors based on these rotations in H1 2022 and Q3 2022.

At EDM, we try to avoid classifying ourselves as “value/growth” managers because, in our view, the essential aim is to invest in companies whose returns (dividends + appreciation) beat inflation. In our opinion, and in keeping with the rhetoric of legendary investors, the distinction between value and growth is not overly relevant: the important thing is to invest in companies that generate value and, to that end, it is vital to invest over the long term and not be alarmed by the price volatility inherent in liquid markets. Expert investors should not be confused: liquidity is one thing, which generates volatility, while the investment horizon is quite another, determining a favourable result if the selection is correct.

C. Different interpretations of the impact of inflation

Finally, I would like to offer a reflection on inflation’s impact on equity portfolios. This semester, the central banks’ reaction to more persistent than expected inflation has precipitated widespread stock market sell-offs. Is this pessimism warranted?

There is no doubt that higher interest rates mean that the present value of future earnings suffers. It is an inevitable mechanical effect that currently prevails, and it especially affects companies in which the value reflects high future growth over a long period of time.

Still, investors do not seem to appreciate the fact that moderate inflation can inflate the future sales and profits of those companies that sell necessary and minimally commoditised products and services that, consequently, can protect their margins. Equity portfolios at EDM fall into this category and we are confident that they will reasonably navigate this inflationary environment, which we believe will persist for the next few years. In fact, the 2022 results already confirm that fact.

A global view of the market that does not discriminate between certain companies and others produces a disconnection between fundamentals and valuations that—as history and our own experience shows—cannot last forever.

2. In transition to financial normalisation: the end of an anomaly

The tightening of monetary policy, which frightens many investors, is nothing more than a normalisation after a decade of unprecedented monetary laxness, in which ample liquidity flooded the markets.

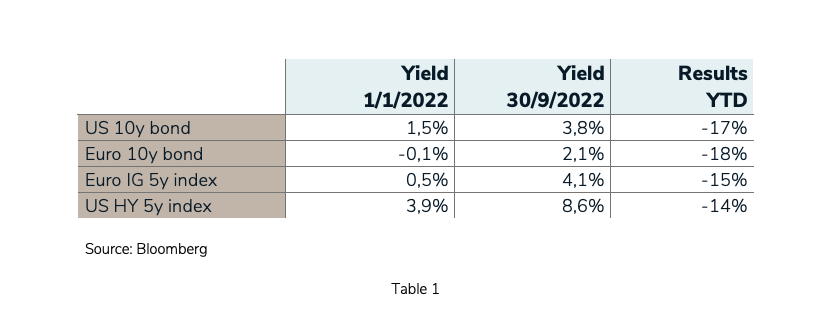

This normalisation, painful as it is, paints a healthier profile for markets in the future. On one hand, liquid assets (money market) and bonds will generate significantly higher yields that in the recent past. This evolution (though at the cost of lower current prices) opens up a positive horizon for investors in need of regular income. The current discomfort is, therefore, the price we pay for a brighter fixed-income future.

We expect equities will be affected as well. When money is plentiful and has little value, investment decisions become more speculative and tend to be based more on investor expectations than on business prospects. A more demanding environment is not a threat to EDM’s investment style.

We at EDM would like to humbly express our frustration at the valuation losses in your portfolio, but we trust that markets, and therefore investors, will regain peace of mind and correct many of the current undervaluations.

Many thanks for your patience and trust.

Yours sincerely,

Carlos Llamas,

CEO

LEGAL CONSIDERATIONS

1) This information, which constitutes EDM advertising, is intended for informational purposes only in accordance with the rules of conduct applicable to investment services in Spain, and is therefore sufficient and understandable for any potential recipient. The information may refer to or entail additional, separate documentation, which you may request from EDM. If this information contains offers of products, financial instruments, or services, recipients may avail themselves to any complementary or additional documentation that enables them the comply with the terms and conditions of the offer in question.

2) EDM Gestión, S.A.U. SGIIC is a limited liability company under Spanish law registered in the CNMV’s Special Registry of Collective Investment Scheme Management Companies (Registro Especial de Sociedades Gestoras de Instituciones de Inversión Colectiva) no. 49, and in the Commercial Registry of Madrid, under volume 36,739, sheet 52, page M-658.326, with tax identification no.: A-58.217.175. Its activity includes the representation, management, and administration of Funds and Investment Companies located in Spain and subject to Spanish law, in addition to discretionary portfolio management.

3) Recipients of this information must take into account the fact that any result or data provided may be subject to fees, commissions, taxes, and expenses, which may decrease or alter the gross result, depending on the nature of each case.

4) The instruments included in this information are subject to the potential effects of several common causes, including:

- Market fluctuations due to unforeseen circumstances.

- Liquidity risk and other risks that alter the evolution of the investment.

5) This information contains data that reflect the past performance of the cited products. The data is a reference or record used to reach a conclusion, but is in no way an indisputable indicator of future performance.

6) This documentation may contain data based on currencies foreign to the recipient. Therefore, the possibility of an upward or downward fluctuation in the value of the currency and its effect on the results of the proposed product or instrument should be taken into account.

7) To ensure discretionary portfolio management services are provided within the scope of suitability, MIFID regulations require EDM to collect the necessary information regarding its clients’ investment goals, financial capacity and investment experience and knowledge. To that end, EDM will obtain the information needed to create an investment profile of each client, consistent with their particular circumstances. Regulation does not permit EDM to render discretionary portfolio management services without the information necessary to assess the suitability of its clients.

8) To obtain the mandatory legal information, please visit the website of the management company EDM Gestión, S.A.U. SGIIC at www.edm.es. You may also obtain a hard copy of this information upon request, free of charge.