Distinguished Customer,

Reading newspapers (whether financial or not) is a scary experience these days. Negative headline follows upon negative headline, repeating and compounding their effect. High inflation. War in Ukraine. Central Banks removing their stimulus packages. Possible cuts to natural gas supplies in Europe. New Covid lockdowns in China. It certainly seems like a good time to withdraw to an island with no internet and forget about equity investments for a while. Or maybe not. Perhaps now is the time to invest. In the following lines we will try to resolve this conundrum.

Every crisis is different. The current one has its origins in both the Global Financial Crisis and the response of governments and central banks to the Covid pandemic. For over a decade we have seen how all efforts to recover healthy levels of inflation (and interest rates) have run up against a wall. The authorities have continued to pile stimulus upon stimulus, until finally inflation returned with a vengeance.

Central banks have reacted to this situation, restoring their authority and credibility. Increasing interest rates, in some cases in an accelerated manner, and removing extraordinary stimulus measures. This is sending out the message that containing inflation is an absolute priority, even at the risk of causing a recession. In other words, and although it may seem contradictory, seeking to dampen demand without necessarily falling into recession.

The investment bank and media doomsayers are key secondary players if this effect is to be achieved. One day they predict the price of Brent at $300, and the next they write that the Federal Reserve will raise rates to 4%. This management of expectations by central banks creates opportunities for investors such as ourselves, who can isolate from the “noise” and take advantage of falling prices. Because “noise” can change direction very rapidly: oil has fallen since then, and now it is expected that the Fed target rates will not reach 3%.

For this reason we try to isolate ourselves from such distortions that predict high returns in future, but which can cloud the investor’s vision. It is true that the macro context is not particularly promising, but it never is when the best opportunities arise. What is more, we have ignored one far from negligible matter: markets have already dropped! And they have done so sharply.

Only two sectors on the S&P500 (the main US stock market index) have avoided such falls: Energy and Telecoms. On the other hand, blue chip companies, those with greater weighting in EDM portfolios, have suffered the most. The technology sector in particular has seen a particularly notable correction of 31% during the year.

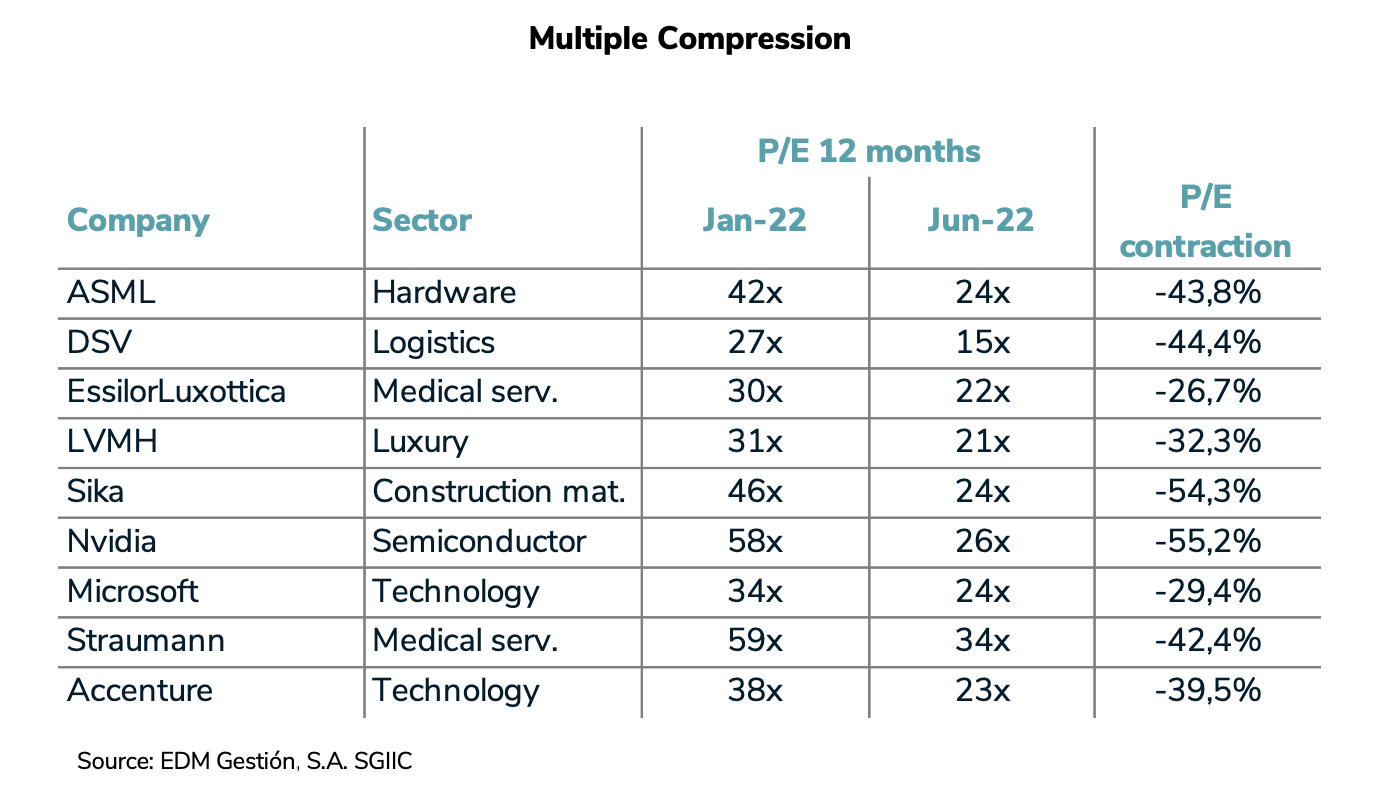

As we have mentioned previously, it is the quality and growth companies that suffer most in these scenarios. Expectations of high inflation (and rising interest rates) cause the P/E ratio multiples at which they are traded to shrink. The table below shows a few examples of the falling value experienced since the start of the year by some of the high-quality firms included in our funds:

These levels of correction are certainly painful, but they are not permanent unless we are mistakenly tempted to liquidate our investments. What is more, they have fallen because of an “external” effect that has had little or nothing to do with them: the actions of central banks and the publications of certain doomsayers. As we have mentioned, such distortions can change direction very quickly.

Remember what happened in March 2020, for example. One day the world was coming to an end (and the stock market with it) and a few months later the market hit new highs thanks to the combined effort of monetary policy and super-expansive fiscal policies. This time it is impossible to predict what the positive “external” factor will be, but there are several candidates: an end to armed conflict, a moderating of inflation …

In the last month we have met with most of the companies in which EDM funds invest. These companies belong to different sectors and different geographical regions. They are all in good health and have not experienced any slowdown in their growth to date. They are currently trading at very attractive prices.

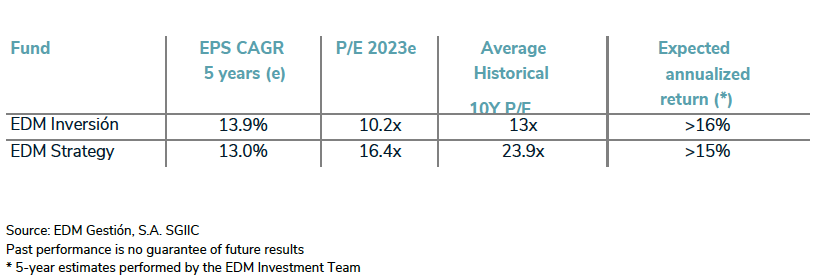

A sound reflection of all this is the cheapening experienced by our funds. Previously we have shown the impact of their price declines (and P/E ratios). In the following table our Investment team has performed a more dynamic exercise to calculate how much both EDM Inversión and EDM Strategy could appreciate over the next 5 years.

On the basis of current values, expected earnings growth and p/e multiple histories, we have arrived at the returns shown in the last column. Although this is just a numerical exercise that we have taken with caution, it offers a view of the safety margin and potential for revaluation that investors can enjoy today.

In short, no-one knows for sure what will happen in coming months. We may possibly continue to live through episodes of volatility. Some companies may not grow as much as expected. However, as I have mentioned in this note, there are positive factors that can be seized upon (the most important of which is the current price of the businesses). A common phrase heard in this industry is “I will invest when all is well.” History provides evidence that if one waits until that moment, it will be too late.

For all these reasons, we recommend the following to our clients:

- Invest in blue chip companies -> Those making up our funds.

- Gradually increase exposure to Equities -> Taking advantage where possible of days when the market is down.

- Do not be led into excessive pessimism because of what we read in the papers -> The best opportunities are generated in these times.

- Wait until the storm (distortions) passes.

Adolfo Monclús,

Head of Asset Management